unified estate tax credit 2021

While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from. For 2021 that lifetime exemption amount is 117 million.

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

New York Estate Tax Exemption.

. For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021. The New York estate tax threshold is 592 million in 2021 and 611 million in 2022. Estate Tax Exemption Basic Exclusion Amount 11700000.

The estate and gift tax exemption is. What Is the Unified Tax Credit Amount for 2021. For 2021 that lifetime exemption amount is 117 million.

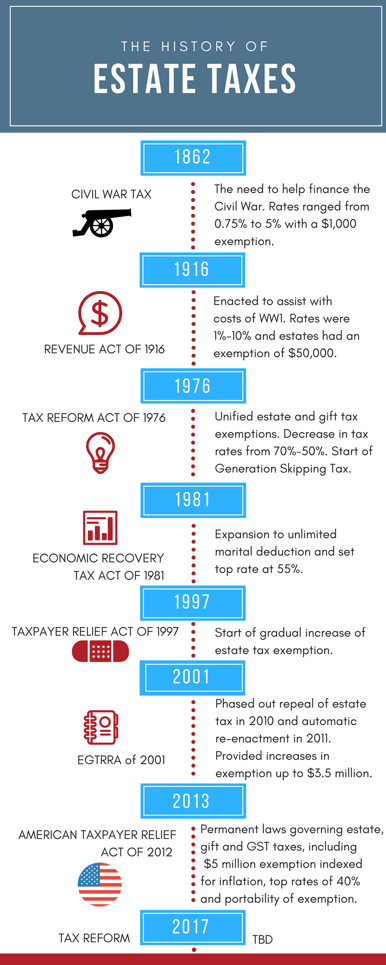

The 2017 Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Get information on how the estate tax may apply to your taxable estate at your death. This is called the unified credit.

Capital gains taxes may change in two. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. After the unified credit limit is reached the donor pays up to 40 percent on.

Is added to this number and the tax is computed. The amount of the estate tax exemption for 2022. The exclusion amount in.

This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples. Learn more about estate taxes by. Assets to the total worldwide estate.

The capital gains tax is a tax on investments that have increased in value. For people who pass away in 2022 the. For 2009 tax returns every American received an automatic unified tax credit against federal estate and gift taxes of 1455800 which is equivalent to transferring 35.

Qualified Small Business Property or Farm Property Deduction. Any tax due is. Gifts and estate transfers that exceed 1206 million are subject to tax.

December 2 2020. The unified credit is per person but a married couple can combine their exemptions. The unified transfer tax is made up of three distinct but closely.

This is called the unified credit. Generation-Skipping Transfer GST Tax Exemption. Wednesday January 20 2021 The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million.

Under the tax reform law the increase is only temporary. The last 2021 tax law change you need to know about is the capital gains tax. That number will keep going up annually with.

The IRS announced new estate and gift tax limits for 2021 during the fall of 2020. The Tax Law requires a New York Qualified Terminable Interest Property QTIP election be made directly on a New York estate tax return for decedents dying on or after April 1 2019. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. Mar 16 2021 The IRS announced in October 2020 that the estate tax exemption will increase to 117 million for tax year 2021.

If the value of the estate is more than five percent of the. For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. 2021-03-15 For 2009 tax returns every American received.

Unified credit against estate tax 2021. For 2021 the estate and gift tax exemption stands at 117 million per person. The gift and estate tax.

The exclusion was 585 million last year and it has been increased to 593 million in 2021 but there is a unique twist in New York. The tax is then reduced by the available unified credit. The unified tax credit is a term encompassing two or more tax exemptions that taxpayers can use in combination to transfer substantial amounts of assets to heirs without triggering the need to.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Exploring The Estate Tax Part 2 Journal Of Accountancy

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

How To Avoid Estate Taxes With A Trust

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Tax Exemption 2021 Amount Goes Up Union Bank

Historical Features Of The Estate Tax Download Table

U S Estate Tax For Canadians Manulife Investment Management

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

U S Estate Tax For Canadians Manulife Investment Management

New York Estate Tax Everything You Need To Know Smartasset

A Brief History Of Estate Gift Taxes

It May Be Time To Start Worrying About The Estate Tax The New York Times

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm