property tax liens nj

2022 Estimated Tax Rate 2796 The 2022 estimated tax bills will be mailed by June 30 th 2022 per State Statute however the figures are available now. The lien is a result of a money judgment issued by the court.

Sales Tax Conflicts Where Two States Tax The Same Transaction

The lien would result in the loss of some or all the property if sold.

. Perform a free Monmouth County NJ public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens. For the most part whether you define a lien as a property lien or a judgment lien depends primarily on how the creditor got the lien. Municipal Sewer is flat rate billed annually with 4 quarterly stubs mailed in December prior to the start of the next year.

Learn more about some of the tricks you can use to lower your property tax. Tax Clerks Ashley Carrera ext. Law has carved out an application for the doctrine in relation to sunken ships.

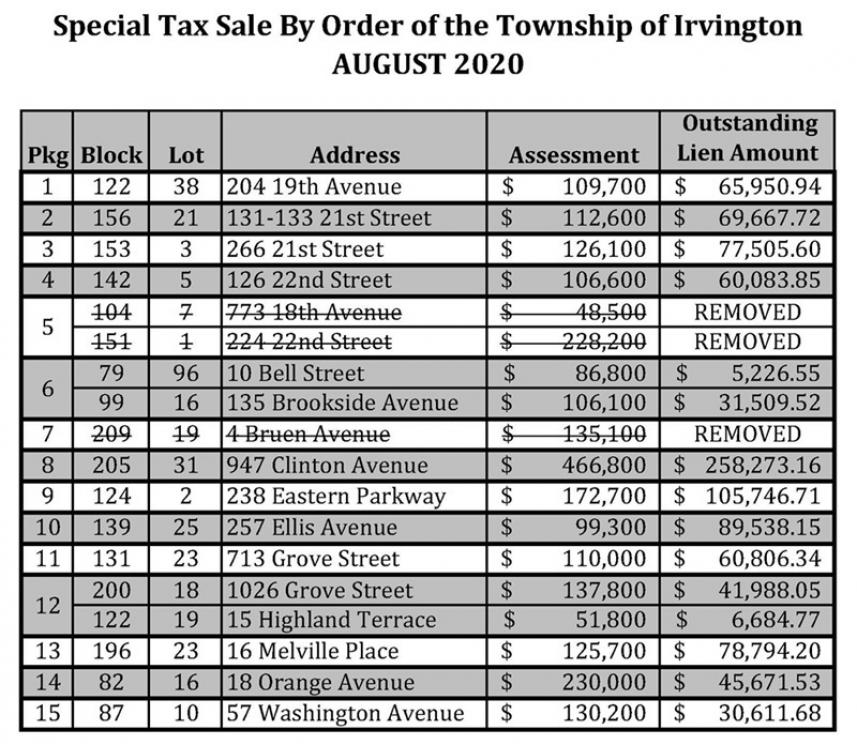

Free Lien Search. A tax lien sale is when the liens are auctioned off to the highest bidder. 1244 Olivia Mata ext.

The lien protects the governments interest in all your property including real estate personal property and financial assets. Investing in Property Tax Liens. Since the amount that the bidder must pay for the lien is fixed by law bidders compete on the basis of the interest rate the property owner is charged if and when the owner redeems the property.

Free Monmouth County Property Records Search. A federal tax lien exists after. 2-10 North Van Brunt St.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. 2101-2106 abandoned shipwrecks which are within three miles of the United States territorial limits belong to the. The highest bidder now has the right to collect the liens plus interest from the homeowner.

Puts your balance due on the books assesses your. Attaches to any California real or personal property you currently own or may acquire in the future. On the other hand creditors get judgment liens as a result of a lawsuit against you for a debt that you owe.

Is effective for at least 10 years may be extended May impact. So if the title policy has missed a lien which is then discovered when reviewing the lenders policy the title company owes no duty to the property owner to pay to remove. While the doctrine of abandoned property typically only applies to personal property US.

We ran a New Jersey lien record search for a John Graves and did not find any medical liens or medicaid liens. Township of Morris Tax Collectors Office 50 Woodland Ave. Englewood NJ 07631 Phone.

Many people look at the purchase of tax liens as an investment opportunity. Township of Berlin Tax Sewer Department. You pay the taxes owed and in exchange you get the right to charge interest on the amount owed by the property owner.

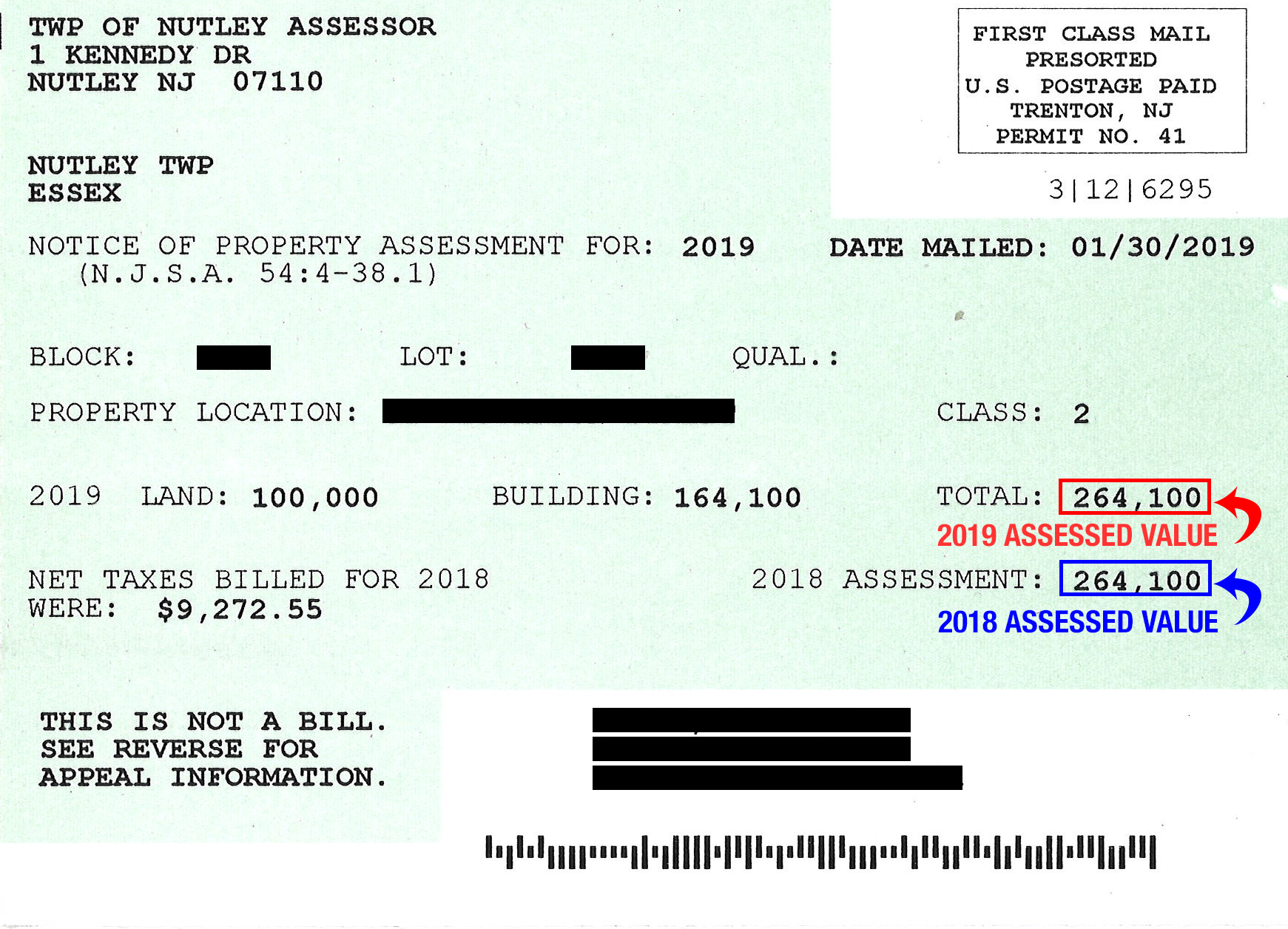

Chances are if theres a lien against your property you at least strongly suspect it. Creditors typically acquire property liens through your voluntary consent. The due date for third quarter property taxes is August 1 stThe 2022 Final2023 Preliminary Tax Bill will be mailed by September 30 th per State Statute.

You are eligible to claim an exemption in all or part of your equity in the property. Nicole Montedoro Assistant Tax Collector Telephone. View tax liens IRS liens property liens personal liens vehicle liens.

Under the Abandoned Shipwreck Act of 1987 43 USC. What Is a Property Lien. New Jersey requires municipalities to hold tax sales of delinquent property taxes at least once a year.

At the very least youre. 1248 Helen Rible ext. Once a Notice of State Tax Lien is recorded or filed against you the lien.

Taxes are billed once a year in July with 4 quarterly stubs on each bill and are due the 1 st of the month with a 10 day grace. You may be able to avoid judgment liens against your home or car in Chapter 7 bankruptcy if all of the following are true. A lien secures our interest in your property when you dont pay your tax debt.

Looking Up a Federal Tax Lien. As a statutory office of the State of New Jersey the tax collector is obligated to follow all of the State Statutes regarding property tax collection including billing due dates interest on delinquent tax payments and tax sale procedures. Burlington County Property Records are real estate documents that contain information related to real property in Burlington County New Jersey.

135 Route 73 South West Berlin NJ 08091 856-767-1854 ext 225. Fourth quarter is due on November 1 st. Under this the beneficiary is the lender not the property owner.

That being said we do show a shoplifting charge for a John D. 1246 View andor Pay Your Property Taxes Online Mayor Amato announces that property owners in Berkeley Township will now be able to view or pay your property taxes. BIDDING DOWN TAX LIENS Bidding for tax liens under the New Jersey Tax follows a procedure known as bidding down the lien.

Mail tax and sewer bills to. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. Education General Dictionary Economics Corporate Finance Roth IRA.

Will You Get A Break On Your N J Property Taxes During Coronavirus Crisis Nj Com

Township Of Nutley New Jersey Property Tax Calculator

Federal Tax Lien Irs Lien Call The Best Tax Lawyer

Franklin New Jersey Tax Lien Online Auction Tax Sale Review Youtube

Gloucester City Tax Sale Information Gloucester City Nj

Freehold Township Sample Tax Bill And Explanation

Editorial New Jersey Property Tax Penalty System Allows Municipalities Investors To Charge 18 Interest Nj Com

Understanding Nj Tax Lien Foreclosure Westmarq

Freehold Township Sample Tax Bill And Explanation

Busting The Myth The Real Numbers Show N J Is Not The Most Overtaxed State In The Nation Nj Com

New Jersey Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

Is New Jersey A Tax Lien Or Tax Deed State Tax Lien Certificates And Tax Deed Authority Ted Thomas

New Jersey Tax Liens Homes Land Oct 2021 Deal Of The Week Youtube

The Official Website Of City Of Union City Nj Tax Department

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

The Official Website Of The Borough Of Roselle Nj Tax Collector